Aadhar Pan Link Name Mismatch / How To Link Aadhaar Card With Pan Card Online Tax2win / Online pf withdrawal not possible if names in pan, aadhar and uan are different govt asks banks to deposit junked notes at rbi by july 20 samsung galaxy m12 is #monsterreloaded:

Aadhar Pan Link Name Mismatch / How To Link Aadhaar Card With Pan Card Online Tax2win / Online pf withdrawal not possible if names in pan, aadhar and uan are different govt asks banks to deposit junked notes at rbi by july 20 samsung galaxy m12 is #monsterreloaded:. According to this new section, everyone has to link their aadhar card to their pan card. This has been mandated by the government as it will help in identifying the taxpayer identity on a firm basis. If individuals do link their aadhar and pan, they will get a penalty of 1000. In case you do not do so by july 1, 2017 your pan card would be invalid, which means you might not be able to file your tax returns. One of the biggest problems in this is mismatch of name.

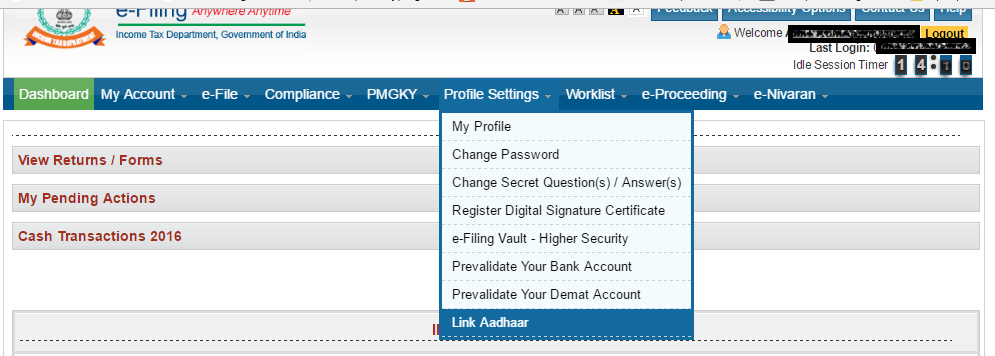

Until now you could link your pan number to aadhaar online or through sms. Aadhaar and pan cards are the two imperative identity proofs issued by the government to indian citizens specially as the government made it mandatory for people to link their pan card with their aadhaar card. Deadline linking of aadhar card with pan card. Online pf withdrawal not possible if names in pan, aadhar and uan are different govt asks banks to deposit junked notes at rbi by july 20 samsung galaxy m12 is #monsterreloaded: Enter your details like your name (as per aadhaar card), pan, aadhaar number and then click on 'submit'.

• in case of a minor mismatch in your registered name in the two, an aadhar otp will be generated and sent to the registered aadhar mobile number.

Online pf withdrawal not possible if names in pan, aadhar and uan are different govt asks banks to deposit junked notes at rbi by july 20 samsung galaxy m12 is #monsterreloaded: In case of any minor mismatch in aadhaar name provided by taxpayer when compared to the actual data in aadhaar, one time password (aadhaar otp) will be sent to the mobile registered with aadhaar. As government mandated requirement of aadhaar and pan link, on a good note it also attended the related common issue which might counter a taxpayer in course of filing itr like the mismatch of names, address, contact, etc and the methods to go with them. If you are trying to link your aadhaar card with the pan card but it is not happening, you need to check details registered with pan and aadhaar cards. The last date for aadhaar pan link was fixed on march 31. According to this new section, everyone has to link their aadhar card to their pan card. The time has increased for new pan holders by six months. The uidai will reject your request to link pan with aadhaar card if there is a mismatch of name, date of birth, gender there are two ways to link pan card with aadhaar card under such circumstances If your name printed on pan card (i.e income tax department) is not matching with the name in pf portal then you are not able to link your pan with uan. Some people were still facing issue mainly due to name mismatch or different date of birth. We tell you how you can link the two. The time for linking aadhar card with pan card has increased by three months. If individuals do link their aadhar and pan, they will get a penalty of 1000.

This has been mandated by the government as it will help in identifying the taxpayer identity on a firm basis. If your name printed on pan card (i.e income tax department) is not matching with the name in pf portal then you are not able to link your pan with uan. I have linked my aadhar, pan and bank details with uan and everything is verified. As government mandated requirement of aadhaar and pan link, on a good note it also attended the related common issue which might counter a taxpayer in course of filing itr like the mismatch of names, address, contact, etc and the methods to go with them. Although for this to happen, the taxpayer should.

In case you do not do so by july 1, 2017 your pan card would be invalid, which means you might not be able to file your tax returns.

If your name printed on pan card (i.e income tax department) is not matching with the name in pf portal then you are not able to link your pan with uan. How to link, correct name mismatch issues supreme court on friday upheld a law that will make the usage of aadhaar mandatory while filing for it returns for those who have it and its linkage to the pan card. This will offer access to updating only the address via online mode. • in case of a minor mismatch in your registered name in the two, an aadhar otp will be generated and sent to the registered aadhar mobile number. So if you want to update your name on aadhaar card, it is mandatory to visit the nearest permanent enrolment center If individuals do link their aadhar and pan, they will get a penalty of 1000. In case of any minor mismatch in aadhaar name provided by taxpayer when compared to the actual data in aadhaar, one time password (aadhaar otp) will be sent to the mobile registered with aadhaar. As government mandated requirement of aadhaar and pan link, on a good note it also attended the related common issue which might counter a taxpayer in course of filing itr like the mismatch of names, address, contact, etc and the methods to go with them. Partial mismatch of the name between aadhar and pan. Moreover, if the pan card isn't linked to the aadhar card soon, the pan card will become dysfunctional. Individuals will not be able to conduct any financial transactions. If not linked, one may also be liable to. Until now you could link your pan number to aadhaar online or through sms.

Due to this sudden move to cut down tax frauds, many issues arose. Link your pan number to aadhaar offline. Although for this to happen, the taxpayer should. In case you do not do so by july 1, 2017 your pan card would be invalid, which means you might not be able to file your tax returns. So if you want to update your name on aadhaar card, it is mandatory to visit the nearest permanent enrolment center

How to link pan with aadhar?

If your name printed on pan card (i.e income tax department) is not matching with the name in pf portal then you are not able to link your pan with uan. If not linked, one may also be liable to. However, later aadhaar pan link last date was extended to september 30, 2019. In case of any minor mismatch in aadhaar name provided by taxpayer when compared to the actual data in aadhaar, one time password (aadhaar otp) will be sent to the mobile registered with aadhaar. Until now you could link your pan number to aadhaar online or through sms. The process of correcting mismatch in names on aadhaar and pan cards can be completed online as well as offline. Some people were still facing issue mainly due to name mismatch or different date of birth. Name, gender and date of birth) should match in both the documents. In case you do not do so by july 1, 2017 your pan card would be invalid, which means you might not be able to file your tax returns. It has to be linked with the permanent account number (pan) by july 31 to pay tax. This will offer access to updating only the address via online mode. However, an individual's name on both the cards must be the same to establish a valid pan link with aadhar. Aadhaar number, name, dob or gender mismatch with registered data / invalid gender details for aadhar authentication.

Very Nice Excellent and Informative. Must Visit Here. annual compliance singapore new company incorporation Visit Our Website.

BalasHapus